Press release: EU-U.S. trade deal must preserve 3.8 million tonnes of tariff-free EU steel exports to the U.S. and stop steel deflection to the EU, says EUROFER - 11 July 2025

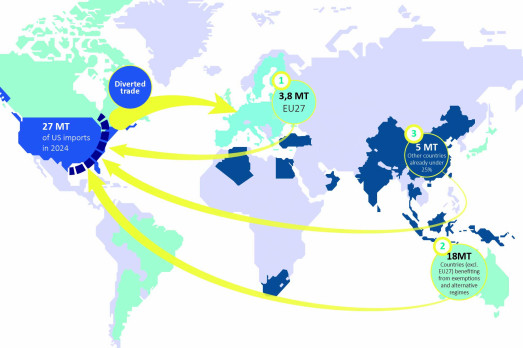

Brussels, 11 July 2025 – The delay and ongoing uncertainty about a deal on tariffs between the EU and the U.S. further worsens the crisis for the European steel industry. U.S. steel tariffs at 50% are adding fuel to an already explosive situation, putting the sector at risk of losing all its exports to the U.S. and facing a surge of deflected trade flows redirected from the U.S. to the EU market. The lack of bold and timely implementation of the Steel and Metals Action Plan is further accelerating the sector’s deterioration, says the European Steel Association.

Press release: EU-U.S. trade deal: in its balancing act, Commission prevented further damage to the EU but for steel impact remains high as long as 50% tariffs remain in place, says EUROFER - 28 July 2025

Brussels, 28 July 2025 – The deal on tariffs struck by the EU with the U.S. limits the damage in the current circumstances, but the impact on European steel remains dramatic as long as 50% tariffs are still applied. A potential joint action EU-U.S. to address global overcapacity and a possible return to a tariff-rate quota system for EU exports to the U.S., as hinted at by Commission President Ursula von der Leyen, are still vague and lack the necessary details to the bring the economic certainty needed by EU steel producers, says the European Steel Association.