Press releases » Global Forum on Steel Excess Capacity must "Finish the job it has started", says EUROFER

Global Forum on Steel Excess Capacity must "Finish the job it has started", says EUROFER

Downloads and links

Recent updates

Brussels, 27 March 2019 – Ahead of the Global Forum on Steel Excess Capacity (GFSEC) meeting on 28-29 March, the European Steel Association (EUROFER) calls for the forum’s mandate to be extended, ahead of its expiry in November. The GFSEC has begun an important transparency and policy process, but its work is not yet complete.

“We call on members of the Global Forum to agree on a continuation of the forum’s mandate beyond November 2019”, said Axel Eggert, Director General of EUROFER. “Continued international work on excess capacity and related government support measures would contribute to the sustainability of our global industry.”

The GFSEC was established in late 2016, on the instruction of G20 Leaders. The Forum set out to gather information and report on the evolution of steel supply and demand conditions, steel production capacity, and government policies that lead to global overcapacity, such as subsidies.

“GFSEC’s work has already produced results, such as detailed statistics on steel capacity and production around the world and has instigated work to cut excess capacity where it is needed most”, added Mr Eggert.

However, while progress has been made – notably an agreement in December 2017 on principles and recommendations whereby countries and regions dismantle market-distorting subsidies and other government support measures and share data and information on the process of capacity reduction – this is still the beginning of the process.

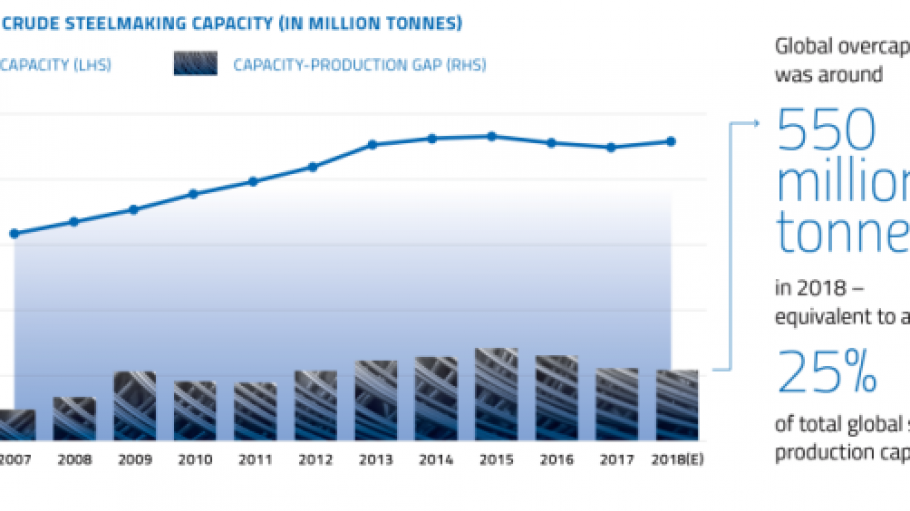

“Global steel overcapacity is still at least 550 million tonnes, according to the OECD”, emphasised Mr Eggert. “We are still very much at the beginning of the process, and there is clearly a need for the GFSEC’s mandate to be extended”.

Since the Forum’s first meeting two-and-a-half years ago, momentum has been steadily building; there is currently a clear level of commitment and resolve among the world’s major steel-producing countries to effectively tackle excess steel capacity, including its root causes. This momentum should not be lost, EUROFER believes.

“In a world where global overcapacity is still very much present – and with proliferating trade distortions – there is a greater need than ever for the GFSEC”, concluded Mr Eggert. “Not renewing the mandate of the Global Forum would mean abandoning the global steel industry when it is still at a perilous juncture. Effective multilateral cooperation is needed in order to preserve fair and free trade in this essential sector”.

Contact

Charles de Lusignan, Spokesperson and head of communications, +32 2 738 79 35, (charles@eurofer.be)

About the European Steel Association (EUROFER)

EUROFER AISBL is located in Brussels and was founded in 1976. It represents the entirety of steel production in the European Union. EUROFER members are steel companies and national steel federations throughout the EU. The major steel companies and national steel federations in Switzerland and Turkey are associate members.

About the European steel industry

The European steel industry is a world leader in innovation and environmental sustainability. It has a turnover of around €170 billion and directly employs 330,000 highly-skilled people, producing on average 160 million tonnes of steel per year. More than 500 steel production sites across 22 EU Member States provide direct and indirect employment to millions more European citizens. Closely integrated with Europe’s manufacturing and construction industries, steel is the backbone for development, growth and employment in Europe.

Steel is the most versatile industrial material in the world. The thousands of different grades and types of steel developed by the industry make the modern world possible. Steel is 100% recyclable and therefore is a fundamental part of the circular economy. As a basic engineering material, steel is also an essential factor in the development and deployment of innovative, CO2-mitigating technologies, improving resource efficiency and fostering sustainable development in Europe.

Download files or visit links related to this content

Strasbourg, 17 December 2025 – The European Commission’s latest proposals on the Carbon Border Adjustment Mechanism (CBAM), unveiled today, correctly identify several loopholes that risk undermining its effectiveness, notably regarding EU exports, downstream sectors and circumvention practices. However, despite these laudable efforts, the measures put forward fail to deliver a comprehensive and durable response to carbon and jobs leakage, warns the European Steel Association (EUROFER).

A milestone occasion to quickly and effectively restore affordable electricity, to relaunch the

decarbonization and strengthen the international competitiveness of the European steel

industry.

Brussels, 02 December 2025 – Unchanged negative conditions – U.S. tariffs and trade disruptions, economic and geopolitical tensions, protracted weak demand and still high energy prices – continue to weigh on the European steel market. EUROFER’s latest Economic and Steel Market Outlook confirms for 2025 another recession in both apparent steel consumption (-0.2%, unchanged) and steel-using sectors (-0.5%, revised from -0.7%). A potential recovery is expected only in 2026 for the Steel Weighted Industrial Production index (SWIP) (+1.8%, stable) and for apparent steel consumption (+3%, slightly revised from +3.1%) – although consumption volumes would still remain well below pre-pandemic levels. Steel imports retained historically high shares (27%), while exports plummeted (-9%) in the first eight months of 2025.